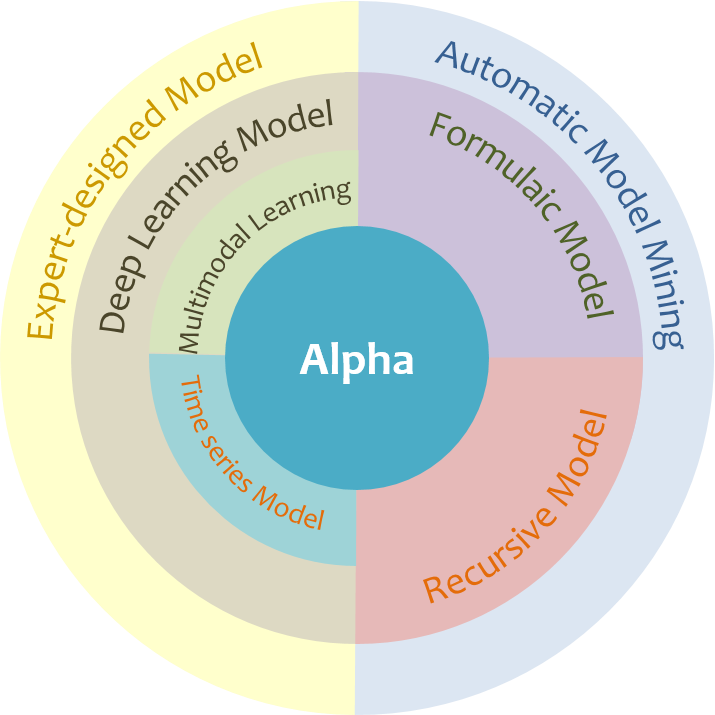

Alpha

Steering through complex financial phenomena, we devise various methods to deliver diverse alphas with good performance.

Raptor is a research project mining diverse alphas in stock markets. Alphas are stock prediction models capturing complex trading signals.

Raptor focus on two research directions:

View our Raptor publication on the ACM Special Interest Group on Management of Data (SIGMOD) 2021:

AlphaEvolve: A Learning Framework to Discover Novel Alphas in Quantitative Investment [ paper link]

Steering through complex financial phenomena, we devise various methods to deliver diverse alphas with good performance.

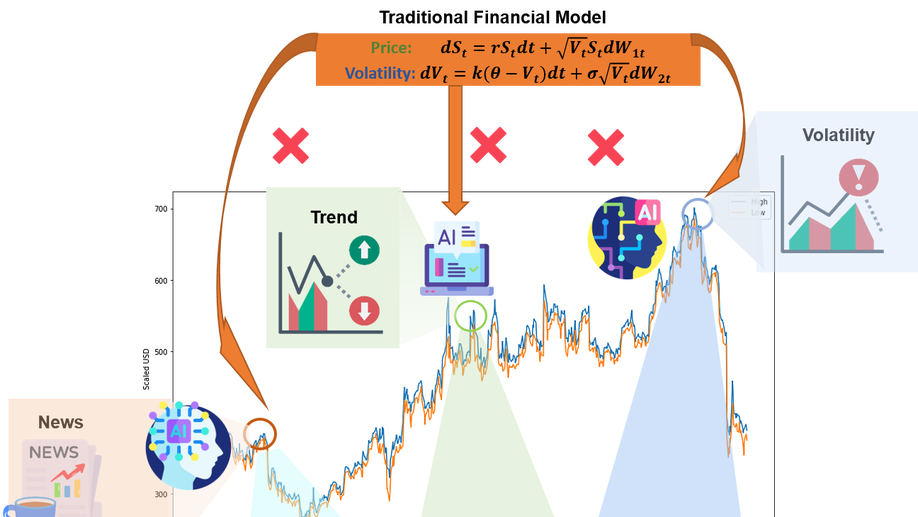

A multi-modal model designed for generalized stock prediction, leveraging mutiple sources of information such as stock price, stock news, and implied volatility.

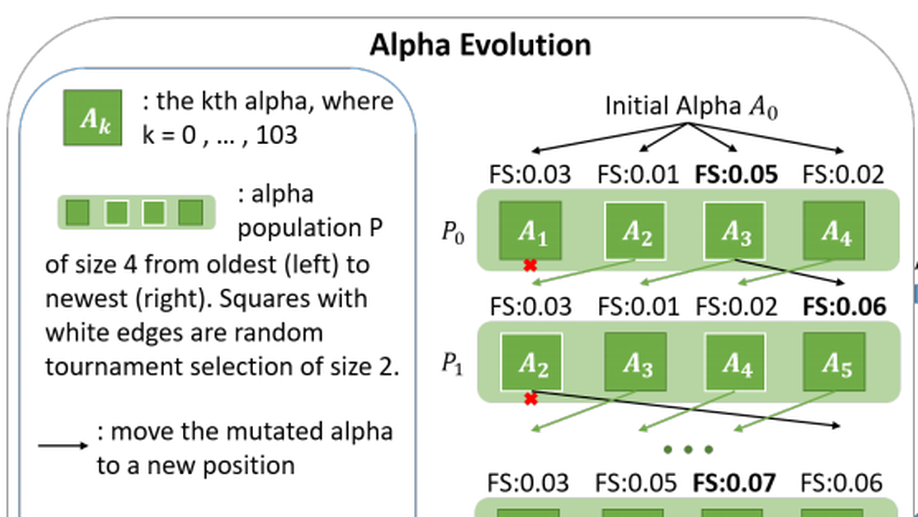

AlphaEvolve is a framework that automatically mines novel alphas with high returns and low correlations with an existing set of alphas.

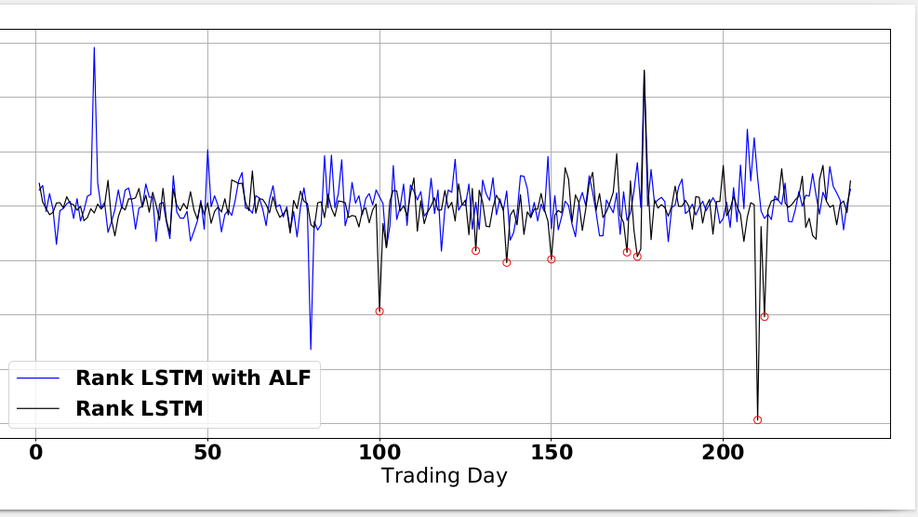

This work focuses on reducing the contribution of noisy instances caused by missing sources of information in model inputs.