Stock Prediction With Noise Awareness

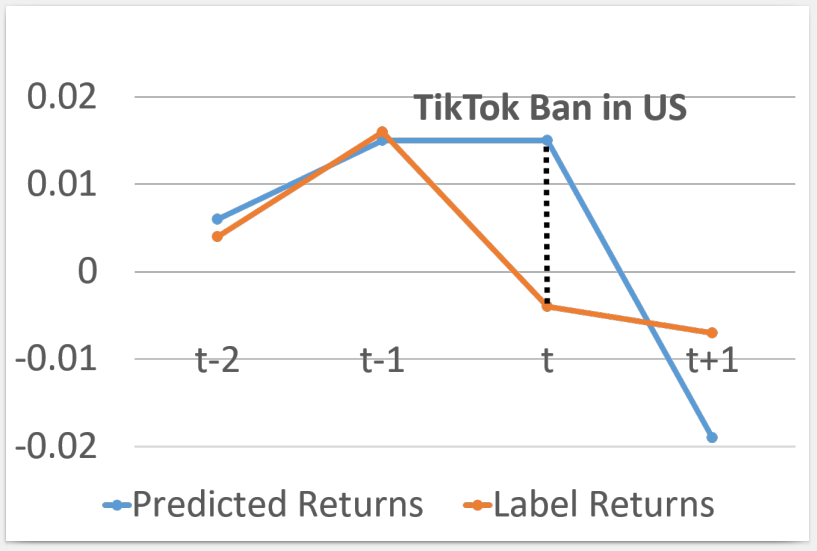

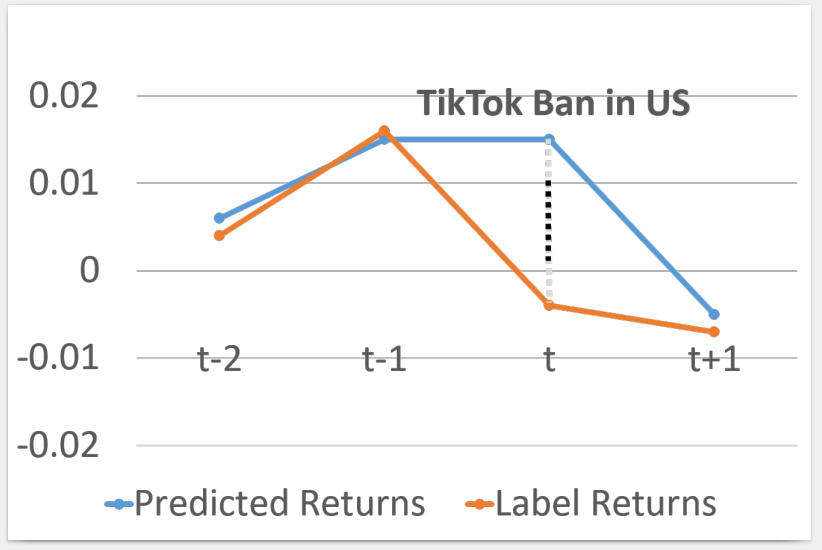

This work focuses on reducing the contribution of noisy instances caused by missing sources of information in model inputs. We first show a motivating example of stock return prediction using a deep learning model for ByteDance, where the black dashed lines represent the prediction losses in the following graph. When a source of information (e.g. TikTok ban in US) is missing in the model input, the Mean Squared Error (MSE) optimizes the noisy instance caused by the missing source of information while our method adaptively relaxes learning the instance. Thus the contribution of noisy instances in the learned model is less.

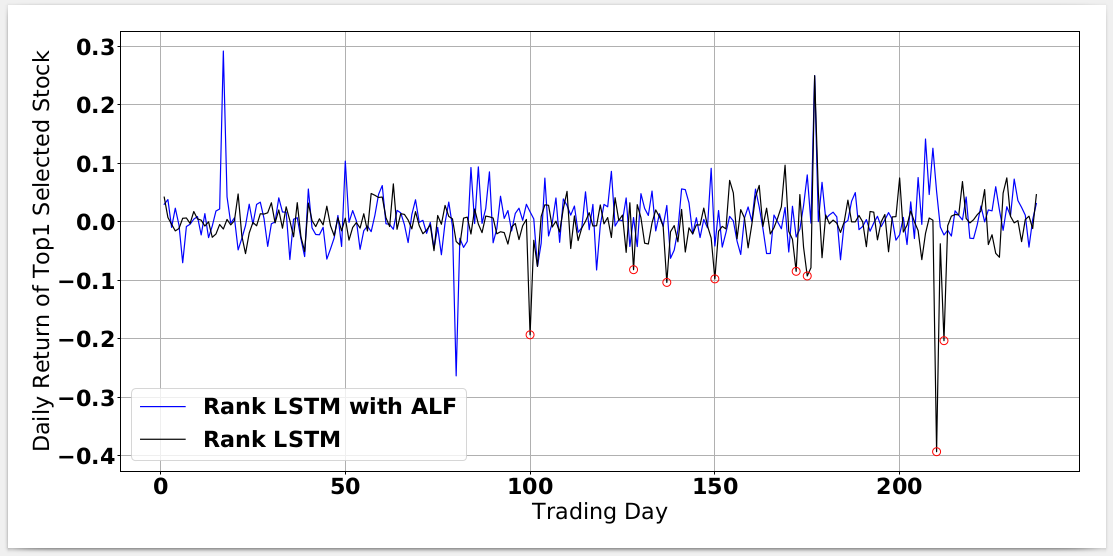

Next we highlight our experiment results. Daily IRR (i.e. the cumulative investment return ratio) in a testing period of one year is plotted for both Rank LSTM (i.e. a variant of the LSTM model with its output mapped to a fully connected layer) and Rank LSTM ALF (i.e. Rank LSTM equipped with our method). The horizontal axis represents the time steps in days and the vertical represents the daily IRR.

We can see that our proposed method, Rank LSTM ALF, shows higher IRR by avoiding many bad choices of stock picking compared to Rank LSTM. This is because Rank LSTM ALF doesn’t force the model to learn noisy instances which impair the model’s inference ability. Rather, Rank LSTM ALF relaxes the model from learning those noisy instances and avoid the model to overreact when encountering similar instances.