Computer Networking

Research Focus

As concrete exampls, I am interested in six of Craig Partridge's Forty Data Communications Research Questions as follows.- How to identify tussle spaces?

- What are the incentives for an implementation to faithfully follow the protocol specification?

- Topology over time?

- Resource auctions.

- How do we place information in a network so that users can access it efficiently?

- What is the right abstraction for programming the cloud?

Software-Defined Inter-Networking Research

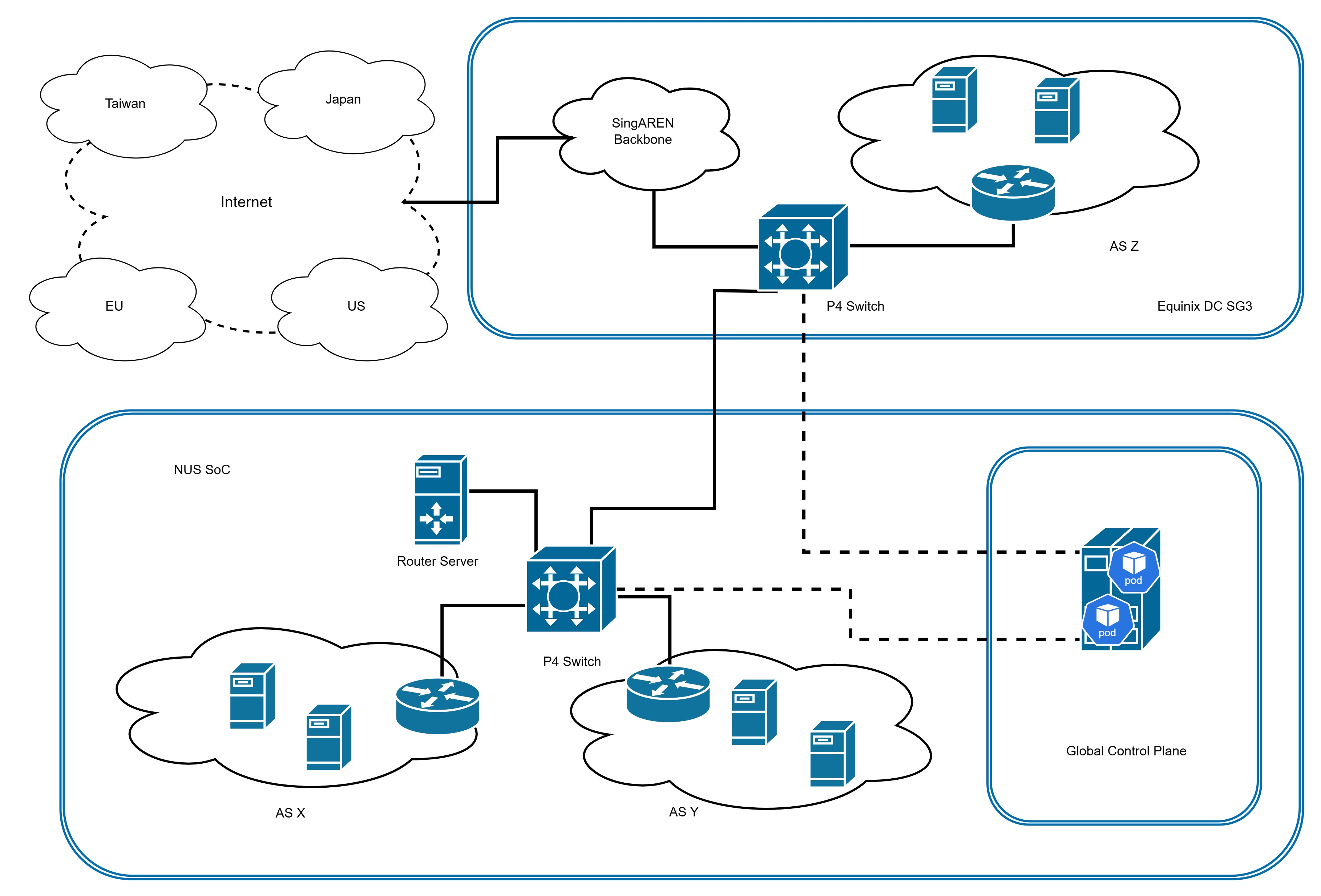

This new networking paradigm provides a logically centralized view of more powerful network management practices. Our current research focuses on the design and implementation of novel inter-networking functionalities enabled by SDN techniques. Thanks to Intel's donation of P4 switches (Netberg Aurora 710 and UfiSpace S9180-32X), we have built a P4 programmable data plane testbed and interconnect with Singapore Advanced Research and Education Network (SingAREN).

The above figure shows the current topology of our testbed consisting of three autonomous systems (ASes) interconnected via P4-programmable switches. AS X and AS Y reside in the NUS School of Computing (SoC), while AS Z is hosted at Equinix Data Center SG3. At SoC, a Router Server communicates with the P4 switch and handles local routing . A Kubernetes-based Global Control Plane manages the control logic, including centralized coordination and configuration of all P4 switches in the testbed. The testbed is interconnected with SingAREN's backbone network, which facilitates the connectivity to other research and educational networks around the world, as well as the broader Internet. This distributed setup supports research into programmable interconnection, inter-domain routing policies, and fine-grained traffic engineering across geographically dispersed ASes. We welcome research collaborations from overseas institutions.

Internet Transport Economics

Due to the best-effort service model of the Internet, the quality of service (QoS) of Internet services however cannot be guaranteed. Furthermore, characterizing QoS is challenging since it depends on the autonomous business decisions such as capacity planning, routing strategies and peering agreements of network providers. The research monograph Internet Transport Economics published by Springer summarizes the past decade of my research on quantifying the QoS for Internet-based services, which takes the Internet infrastructure as a transport system for data packets and study the Internet ecosystem and the economics of transport services collectively provided by the autonomous network providers. In contrast to the traditional transport economics that studies the movement of people and goods over space and time, our focus in the Internet transport economics is the movement of streams of data packets that create information services.

Auction-Based Resource Allocation for Cloud Service Differentiation

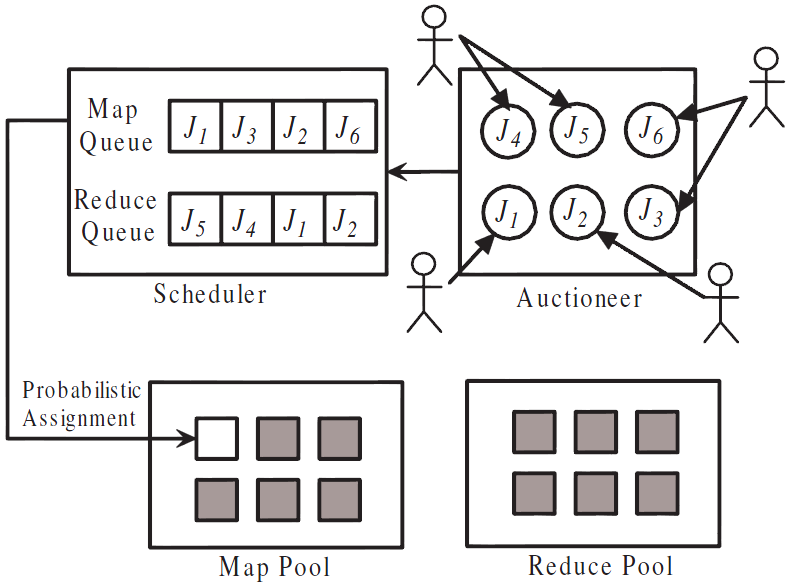

Most existing cloud systems don't recognize users with different preferences or jobs of different natures. This doesn't permit the cloud system to provide service differentiation, which allows a company to pay more in order to get better service, such as more space, faster connections or fewer delays. The lack of service differentiation leads to an inefficient allocation of cloud resources. Abacus is a generic resource management framework that interacts with users to allow them to specify their priorities and job characteristics. Based on this information, Abacus is able to allocate and schedule resources most efficiently.

In Abacus, different jobs receive different quality of service, based on the amount of money the owners of the jobs pay to the cloud platform. Through a carefully designed auction mechanism, Abacus ensures that every job owner's best bidding strategy is to simply tell their true valuation of the job, thus eliminating the need to play price games. To determine pricing of cloud resources, Abacus uses an auction, where users bid more to get more resources, and consequently, better service. The auction mechanism ensures nice properties for users, such as monotonicity, which is when a user pays more, they always receive better service, and truth-telling, which is where a user bids on what they can afford, without studying what other users are bidding. In a poorly designed auction, each user needs to monitor what others bid and respond accordingly and the price often fluctuates a lot; however, Abacus ensures that a user only needs to bid according to her own budget and the price is relatively stable over time.

References

-

Zhenjie Zhang, Richard T. B. Ma, Jianbing Ding and Yin Yang.

ABACUS: An Auction-Based Approach to Cloud Service Differentiation.

Proceedings of IEEE International Conference on Cloud Engineering (IC2E), pp. 292-301, San Francisco, California, USA, March 25-28, 2013.

The Public Option: An Alternative to Network Neutrality

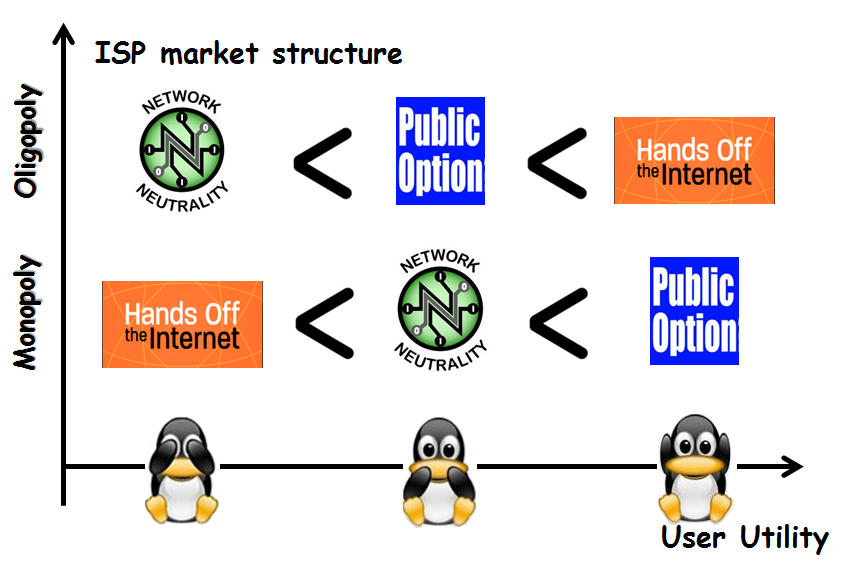

Because the Internet only offers a single class of "best-effort" service, it has been a real challenge to enable seamless end-to-end communications and guarantee quality of service (QoS) for real-time immersive telepresence. Besides the engineering factors, this goal becomes even more difficult to be accomplished under the Network Neutrality principle which disallows Internet Service Providers (ISPs) to offer premium services to companies that choose to pay higher fees. While the potential Network Neutrality legislation is still hotly debated in the US and worldwide, We have found a less-intrusive regulatory alternative for the Internet industry: the introduction of a Public Option ISP, which provides higher socio-economic values to Internet users and allows ISPs to efficiently differentiate prices/services.

The success of the Public Option approach will have multifold potential impacts on reshaping the landscape of the Internet ecosystem. It will create more competitive and efficient ISP markets and allow diversity in the Internet industry. It will also provide new economic incentives and enable new business models for ISPs to provide new services and better utilities for users. Through competition, more innovative applications will emerge and be supported by the future Internet. Most importantly, the Public Option ISP always plays a role as a safety net for the users by implementing a network-neutral policy which does not prioritize content traffic. The presence of the Public Option will incentivize profit-seeking ISPs in the market to perform paid prioritizations that benefit users; otherwise, they will switch to the Public Option for a better single class service.

References

-

Richard T. B. Ma and Vishal Misra.

The Public Option: a Non-regulatory Alternative to Network Neutrality.

IEEE/ACM Transactions on Networking, Volume 21, Issue 6, pp. 1866 - 1879, December, 2013. -

Richard T. B. Ma and Vishal Misra.

The Public Option: a Non-regulatory Alternative to Network Neutrality. [Presentation Slides]

Proceedings of ACM Conference on emerging Networking EXperiments and Technologies (CoNEXT 2011), Tokyo, Japan, December, 2011. -

Jacob Davidson.

Why President Obama's Plan Just Might Fix the Internet.

Money Magazine, Jan. 16, 2015.

Economics of the Internet and ISP Settlements

The Internet is composed of thousands of network systems operated by autonomous Internet Service Providers (ISPs). ISPs have to interconnect to and interact with each other to provide Internet services for their customers. Due to the selfish profit-seeking nature of the ISPs, the cooperation among ISPs does not happen voluntarily. In fact, various selfish behaviors encumber the cooperation and induce multiple consequences on the Internet.Problems

- The Selfish Routing Problem

ISPs can make routing decisions by forwarding packets to different neighboring ISPs. Instead of choosing the best path to forward packets, ISPs make choose the least costly routing path to traverse inside its own network. This is often done by using "hot-potato" routing which always forward packets through the nearest egress point to save routing costs. These selfish routing behaviors make the Internet extremely inefficient.

- The ISP De-peering Problem

Decades ago, ISPs were homogenous and the traffic pattern was symmetric. They used to interconnect with each other by zero-dollar peering agreements. However, today's ISPs differ dramatically by their characteristics. For example, we can classify ISPs into three categories by the customers they serve: 1) eyeball ISPs that serve individual home-users to get Internet access, 2) content ISPs that serve content providers like Google/Yahoo and Content Distribution Networks (CDNs) like Arkamia, and 3) transit ISPs that serve other ISPs for transit services. ISPs start to charge each other, but not all ISPs are willing to pay what the other party charges. In Oct. 2005, one of the largestest transit ISPs LEVEL 3 unilaterally disconnected all peering links with another transit ISP Cogent, resulting at least 15% of the Internet unreachable for the customers of both ISPs at that time. Without an appropriate compensation structure, ISPs don't have incentive to cooperate by interconnecting and the Internet will start to Balkanize.

- The Network Neutrality Debate

Another unsolved problem that hinders the development of the Internet is the debate of network neutrality, which argues whether service differentiations should be provided for Internet services. Eyeball ISPs and transit ISPs support for providing differentiated services, since they want to recoup their investment through differentiated prices. However, content providers advocate the neutrality of the network, which prohibits the discriminations on delivering different contents on the network. They worry about the market power of the incumbent ISPs and their ability to extract profit. Again, without an appropriate compensation structure for the ISPs to share profits, it's difficulty for all ISPs to cooperate and provide better services for customers.

Solutions

- The Shapley Value Solution

Proposed by Lloyd Shapley, the Shapley value solution can be used to share profit among a group of cooperative entities. This solution satisfies multiple desirable properties. We introduce three desirable properties that uniquely define the Shapley value solution. We use the following simple example to explain. For a simplified PC industry, we have Microsoft that produces the operating system, i.e. Windows, and Intel and AMD that produce micro-processors. Suppose the profit V from the industry is the total revenue minus the total cost incurred in all firms. The Shapley value solution tells what is the appropriate profit sharing solution for all three firms.- Efficiency Property: The profit of all three firms should sum up to V.

- Symmetry Property: The two symmetric processor producer should obtain the same amount of profit.

- Fairness Property: For any pair of firms, their marginal contribution to each other should be the same.

The Shapley value suggests that the unique solution satisfying all above three properties is to give Microsoft 2/3 of the total profit, and 1/6 for both AMD and Intel. By checking the balanced contribution property, we know that without the help of Intel, Microsoft had to evenly share profit with AMD, so the marginal profit is 2/3 - 1/2 = 1/6. It is also the marginal profit Microsoft provides to Intel, because without Microsoft, both processor makers will earn zero profit.

- The Shapley Mechanism

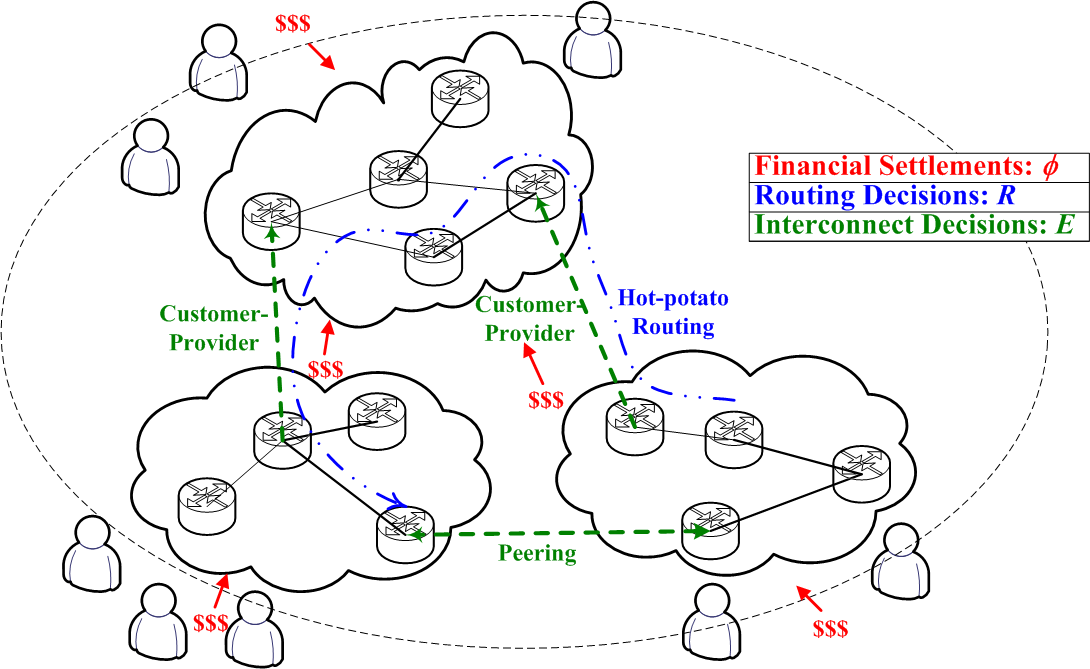

Given any static settings of a market structure, we can find the ideal Shapley value profit sharing solutions for all participating entities. We consider the Internet as a group of cooperative ISPs generating profits by serving customers. Each ISP can make selfish decisions on routing and interconnecting. We explore the behaviors of the ISPs and the evolution of the Internet under the policy where a Shapley value profit-sharing is enforced.

From the figure above, we can enforce a financial settlement mechanism based on the Shapley value solution. Each individual ISPs make various selfish decisions, including routing and interconnecting decision. We have shown that the whole Internet will evolve to converge to a Nash equilibrium where the social welfare is maximized and the global cost is minimized. This means that under the Shapley value mechanism, each ISP's individual profit objective coincides with the global optimality of the Internet.

References

-

Richard T. B. Ma, Dah Ming Chiu, John C. S. Lui, Vishal Misra and Dan Rubenstein.

On Cooperative Settlement Between Content, Transit and Eyeball Internet Service Providers.

IEEE/ACM Transactions on Networking, Volume 19, Issue 3, June 2011. -

Richard T. B. Ma, Dah Ming Chiu, John C. S. Lui, Vishal Misra and Dan Rubenstein.

Internet Economics: The use of Shapley value for ISP settlement.

IEEE/ACM Transactions on Networking, Volume 18, Issue 3, June 2010. -

Richard T. B. Ma, Dah Ming Chiu, John C. S. Lui, Vishal Misra and Dan Rubenstein.

On Cooperative Settlement Between Content, Transit and Eyeball Internet Service Providers. [Presentation Slides]

Proceedings of ACM Conference on emerging Networking EXperiments and Technologies (CoNEXT 2008), Madrid, Spain, December, 2008. -

Richard T. B. Ma, Dah Ming Chiu, John C. S. Lui, Vishal Misra and Dan Rubenstein.

Interconnecting Eyeballs to Content: A Shapley Value Perspective on ISP Peering and Settlement. [Presentation Slides]

Proceedings of ACM Network Economics (NetEcon '08), Seattle, August, 2008. -

Richard T. B. Ma, Dah Ming Chiu, John C. S. Lui, Vishal Misra and Dan Rubenstein.

Internet Economics: The use of Shapley value for ISP settlement. [Presentation Slides]

Proceedings of ACM Conference on emerging Networking EXperiments and Technologies (CoNEXT 2007), New York, USA, December, 2007.