The advent of financial technology or fintech has significantly transformed the way we manage money, make transactions, and access financial services. Digital assets, including cryptocurrencies and blockchain-based tokens, have emerged as an essential component of the fintech ecosystem.

These assets offer new opportunities for investment, transfer of value, and decentralised financial services. However, the custody of such digital assets poses unique challenges.

Security and Asset Protection

There is a need to develop robust security protocols and encryption methods to protect users’ funds and assets from theft, hacking, and unauthorised access.

Regulatory Compliance

As digital assets gain traction, regulatory bodies are working to establish guidelines for their custody. The formulation of effective regulations and ensuring that custodial services are compliant and accountable are imperative.

User Experience

Custodial solutions play a vital role in the user experience of digital assets. There is a dire need for user-friendly interfaces and seamless integration with fintech platforms, encouraging broader adoption.

Interoperability and Standardisation

Fintech relies on interoperability between various services and platforms.

Institutional Adoption

Custody solutions that meet institutional requirements for security and compliance can pave the way for wider institutional adoption.

Inheritance and Asset Recovery

The management of digital assets in the event of the owner’s incapacitation or passing is a complex issue. We are currently lacking solutions for secure inheritance planning and asset recovery mechanisms.

Fintech reshapes the financial landscape, empowering individuals and businesses with greater financial access and flexibility. However, overcoming the challenges—with particular regard to custody of digital assets—in the fintech space is crucial for its sustained growth and positive impact.

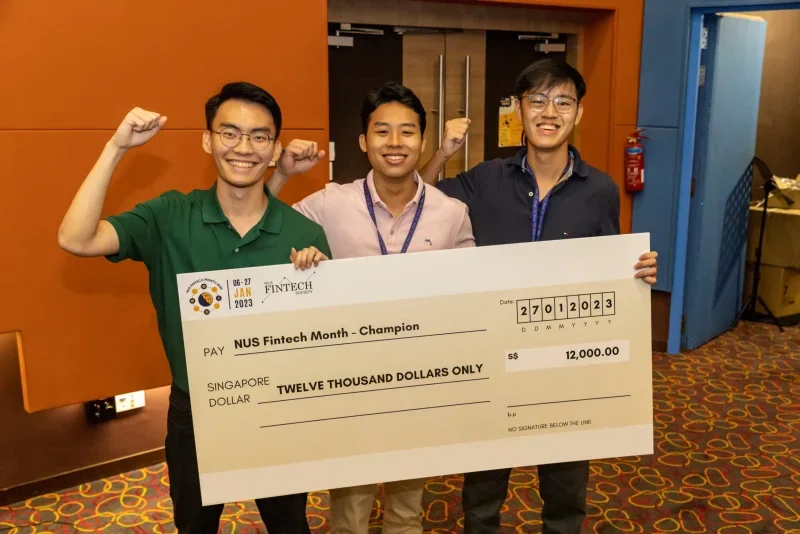

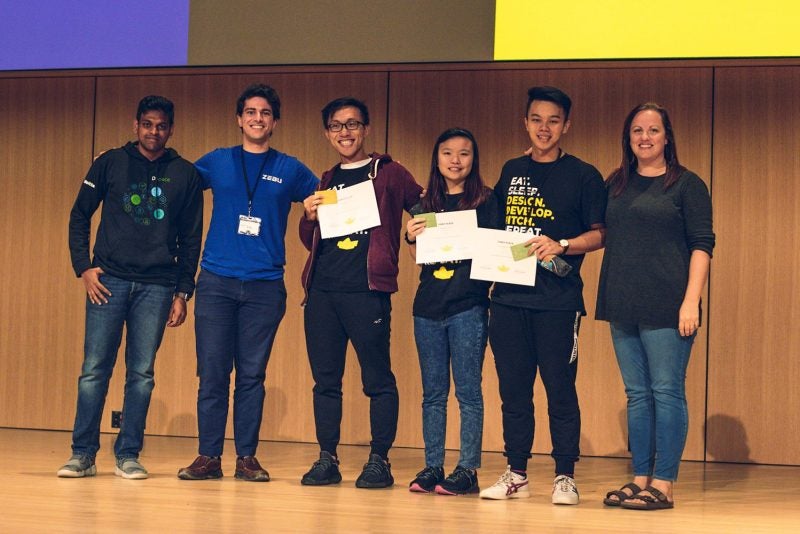

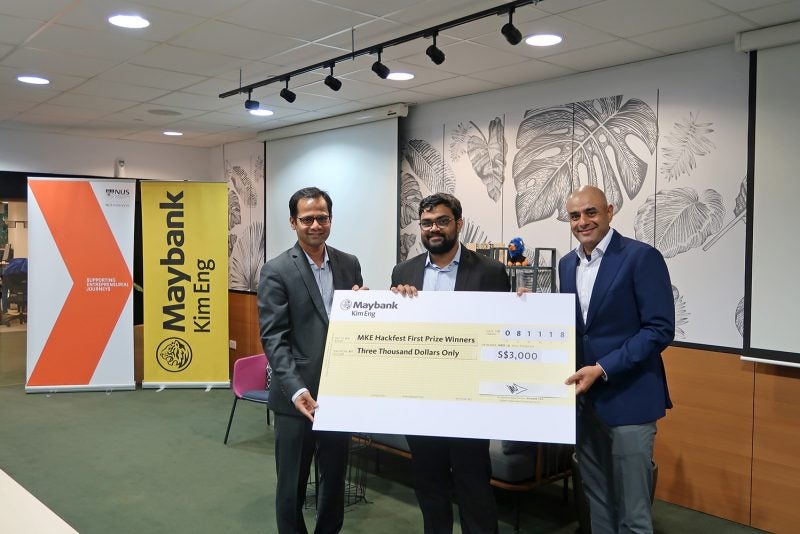

Addressing these challenges, which require innovative integration of technological and financial knowledge, excites the faculty and students at NUS Computing. NUS Computing, the Asian Institute of Digital Finance (AIDF) and Northern Trust have recently announced a series of research and industry development initiatives to define the future of blockchain for institutional investors. This strategic partnership can “drive the development of new digital marketplaces and blockchain solutions for the industry,” explains Lee Kong Chian Centennial Professor Ooi Beng Chin.

Conducting research in digital asset custody will lead to advancements in areas such as security, compliance, user experience, and accessibility. By addressing these challenges, fintech can create a more secure and inclusive financial ecosystem that fosters trust and confidence among users. The partnerships between researchers, policymakers, and industry can unlock the true potential of fintech and usher in a future where digital assets play a vital role in shaping the global economy.

Read the full Press Release: Northern Trust, NUS School of Computing and NUS Asian Institute of Digital Finance join forces to support blockchain development for institutional use.